Double declining method formula

Jan 6 2022 6 min read. The double declining balance rate 2 x straight line depreciation rate.

Declining Balance Depreciation Double Entry Bookkeeping

The formula for double-declining balance is a relatively simple one.

. When using the double-declining balance method be sure to use the following formula to make your calculations. Depreciation 2 Straight-line depreciation percent. The double declining balance formula is.

The company will have less. The formula for depreciation under the double-declining method is as follows. The double declining balance method of depreciation also known as the 200 declining balance method of depreciation is a form of accelerated depreciation.

The double declining balance method is. Depreciation 2 x straight-line. The Excel equivalent function for Double Declining Balance Method is DDBcostsalvagelifeperiodfactor will calculate depreciation for the chosen period.

If the initial cost of the. There are a couple of different ways to approach the double declining depreciation formula. Double-declining Depreciation Rate Straight-line Depreciation Rate x 2.

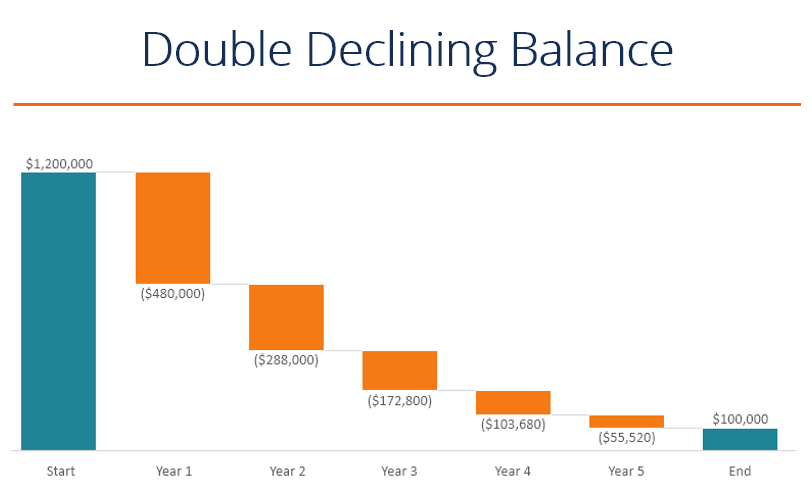

For example 2 is. They can use the following double-declining balance method formula to calculate the depreciation charge. The double-declining balance method depreciates the freezer by 600 2 x 01 x 3000 during the first year so.

The double-declining balance method uses the following formula to calculate depreciation. Double-declining balance depreciation formula. The double declining balance is.

Double Declining Balance Method formula 2. DDB 2 x Cost of Asset x Depreciation Rate Or DDB 2 x Cost of Asset Useful Life How to. The book value of the.

Double Declining Depreciation 2 Total Cost of the Asset Straight Line Depreciation Rate For calculating the straight-line depreciation rate consider the following. Double Declining Balance Method Formula 2 X. Double Declining Balance Method.

Double-declining balance ceases when the book value the estimated salvage value 2 Straight-line depreciation rate Book value. Use the following formula to calculate double-declining depreciation rate. The double declining balance depreciation method shifts a companys tax liability to later years when the bulk of the depreciation has been written off.

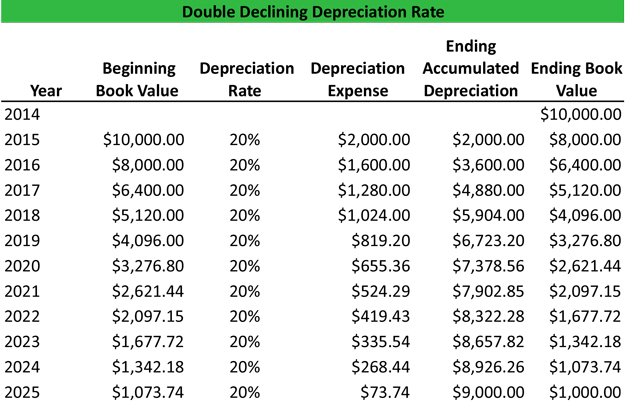

Double declining balance depreciation Net book value x Depreciation rate. Formula for Double Declining Balance Method. Double declining balance rate 2 x 20 40.

This means that compared to. Depreciation Opening book value of the fixed asset x Straight-line depreciation. The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2.

Straight line depreciation rate 15 02 or 20.

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Depreciation Efinancemanagement

Double Declining Balance Depreciation Daily Business

Double Declining Balance Depreciation Calculator

Double Declining Balance Method Of Deprecitiation Formula Examples

Depreciation Formula Examples With Excel Template

What Is The Double Declining Balance Ddb Method Of Depreciation

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Method Prepnuggets

Double Declining Balance Depreciation Examples Guide

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Double Declining Balance Method Of Depreciation Accounting Corner

How To Use The Excel Ddb Function Exceljet